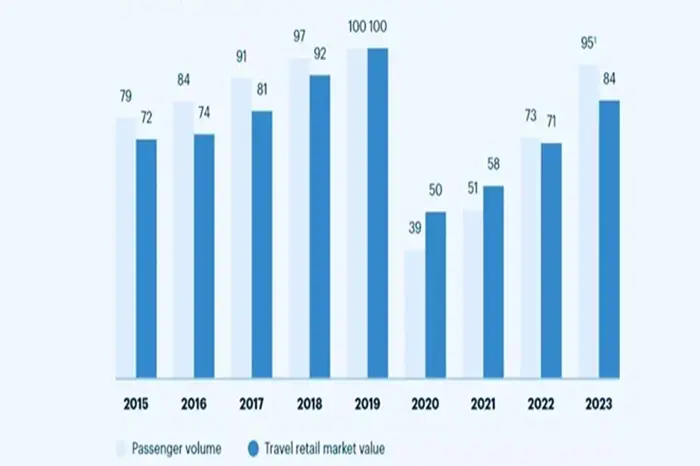

A recent report by Kearney highlights a significant shift in the travel retail sector, revealing that sales are growing at only half the rate of passenger traffic. Historically, the travel retail channel benefited from steady increases in passenger numbers, which propelled retail sales growth at comparable or even higher rates. However, this correlation has weakened in the post-COVID landscape.

At the recent Tax Free World Association (TFWA) exhibition in Cannes, France—an annual gathering for key players in the duty-free industry—the report dispelled several industry misconceptions. Notably, it challenged the belief that China would consistently provide a stream of high-spending travelers. While Chinese tourists are returning to major markets such as South Korea, their spending habits have not rebounded as anticipated.

According to the Kearney report, commissioned by TFWA, passenger volumes increased by 30% last year, significantly surpassing travel retail sales, which only grew by 18%. This discrepancy has resulted in a global travel retail market valued at $72 billion but has also marked the first time in the industry’s history that sales growth diverged from passenger traffic growth.

The report identifies multiple factors constraining retail sales, including reduced spending from Chinese travelers, which has particularly impacted the Hainan market. Additionally, Kearney warns of the long-term erosion of travel retail’s price advantage. “While enthusiasm for shopping in airports remains strong, consumer behavior and expectations across generations are evolving under new pressures,” the firm stated.

Related Topics:

10 Things to Do in Staten Island Near Ferry

10 Things to Do in New York in July

7 Things to Do at Chelsea Market